How to Profit from Property When House Prices Are Predicted To Fall

The property boom experienced during lockdown has caused prices to reach an all-time high and the idea of a slowdown was in doubt, but as we enter a recession, industry experts predict that house prices could start to fall over the next couple of years, which could present great investment opportunities for savvy property investors.

As everyone prepares for house prices to drop, we take a look at the potential impact that awaits the property market, the pros and cons of investing in property during a recession, and we will also highlight ways to prepare to take advantage of the property market when the timing is right.

Why Have House Prices Gone Up So Much?

The latest ONS figures show that the average property price reached £286,397 in June 2022. That’s an annual rise of nearly 8% and a monthly rise of 1%. The below chart displays the annual UK property price change over the past 5 years.

The above chart paints a clear picture of how the Covid-19 breakout and the introduction of lockdowns at the start of 2020 impacted nationwide house prices. A considerable spike appeared as social and lifestyle needs changed, causing buyer demand to grow as many chose to relocate in search of additional space and better value for money.

On a regional level, Scotland has seen the biggest annual change in 2022 of 11.6%, followed by the East of England and Northern Ireland, both at just under 10%. This sudden surge in demand is one of the main causes of increased prices, followed by other factors such as reduced mortgage rates and the stamp duty holiday.

Are We Facing a Recession?

Last year, the peak inflation rate forecast stood at 11%, but as reality continues to surpass predictions, the first UK recession in 11 years was declared in August 2022. But what does this mean for the next few years?

The below chart maps out the Bank of England’s inflation forecast for the near future.

With inflation already at a 30-year high, the Bank of England now expects inflation to start to drop from its peak.

Inflation will fall further early this year as last year’s sharp price increases are not repeated, and that will allow the Bank of England to limit future rate rises.

Due to costs soaring across all areas of life, the Bank of England has been forced to issue successive interest rate increases since December 2021, which are currently at their highest level in almost 15 years. The Bank of England looks set to push its official borrowing costs to 4% in February this year. After that, though, it may decide to wait and see what happens.

In terms of recession fears, the UK’s GDP could be tight for a while yet before things start to level out. However, this isn’t the first time the economy has taken a hit, there could be some comfort to take in historic data.

Research shows that the average recession lasts around 11 months and, looking at our most recent example, we had a relatively speedy bounce back. During the Covid-19 pandemic, UK GDP fell by a record of 19.4%, but this drop recovered after the first lockdown when the country reopened for the summer and GDP rose again by nearly 18%.

The last two years are just one example of how reality can defy expectations as the housing market thrived despite industry predictions of a crash. So, while each case is different, it may not be what we think this time.

Pros and Cons of Buying Property in a Recession?

Despite the implications of poor economic performance when we’re in a recession, it’s not all negative, and when it comes to property investing, a recession could lead to some significant opportunities for experienced property investors who are ready to buy.

Below are some of the pros and cons that a recession can present for the property investment market:

On the surface, a recession means an unhealthy financial climate and high living costs. However, there are several ways for experienced property investors to make the most of the property market during a recession, such as simply being prepared.

If you’re a buyer of property armed with cash in the bank, you could be better positioned to take advantage of reduced asking prices or investing in property opportunities that beat inflation rates.

There is no way to predict how long it’ll take for economic health to recover; equally keeping investment capital stuck in your bank costs you money whilst inflation remains high. Hence savvy property investors are now considering ways to invest in property whereby the returns are greater than that of the inflation rates currently experienced.

How to Profit from Property When House Price are Predicted Fall

There are several ways that property development companies can find business and growth opportunities in a recession. This includes:

- Paying less for a property: An opportunity that can be spotted during a recession is offering less for development sites. Some vendors will be open to selling for less than previously expected as they too will be aware of house prices being predicted to drop. 9 times out of 10, a vendor sells a development opportunity site due to financial reasons as opposed to emotional.

- Reduced competition: In the example of sourcing new sites, property developers could find less competition for a piece of land they want to acquire, often leading to cheaper prices as a result.

- Delaying the sale resulting in less supply: As the economy approaches its peak, some property developers and house builders may choose to hold back on selling a development until house prices recover (as a way to maximise profits), which means less properties on the market for buyers to purchase. This is something the UK Government will be keen to avoid as the predicted death, birth and marriage rates remain the same hence the undersupply issues will also remain until 2030 (and potentially beyond that date) whether we’re in a recession or not

How JaeVee Prepares for Recessions

At JaeVee, we take certain measures to make our business strategy work in recessional environments in all three sectors that we operate in:

Residential - We factor into our feasibility studies and projected returns when acquiring a development site that the potential property values that make up the GDV could drop between 5-10% hence we acquire the site for 5-10% less.

It’s economies of scale; if the end-user property values are lower, then the land acquisition purchase price is lower.

Ultimately, as long as the margins remain the same then there’s no impact on development profits.

There’s an old age saying in property development that you make money when you buy, not when you sell. So the emphasis in 2023 is that we buy well i.e. use the reported house price drops with vendors to get development sites for less money than we would have paid 12 months ago.

In the residential sector, the undersupply issue until 2030, will continue to ensure demand for property over the next 10 years. The current position of the economy does not change the fact that people still need homes and that there is an undersupply of them.

In terms of why to invest with JaeVee, let's be clear, the buy to let market is dead and doesn't represent a good opportunity which is why investing for today isn't viable in the current climate.

However, when investing in a joint venture property development, you're investing based on how the market is at the point of exit and not how it is today.

The majority of small to medium sized developments take a minimum of 18 months. With that in mind, your due diligence in deciding upon whether you wish to invest in the property development sector is driven by how the market will look in 2025 and not today.

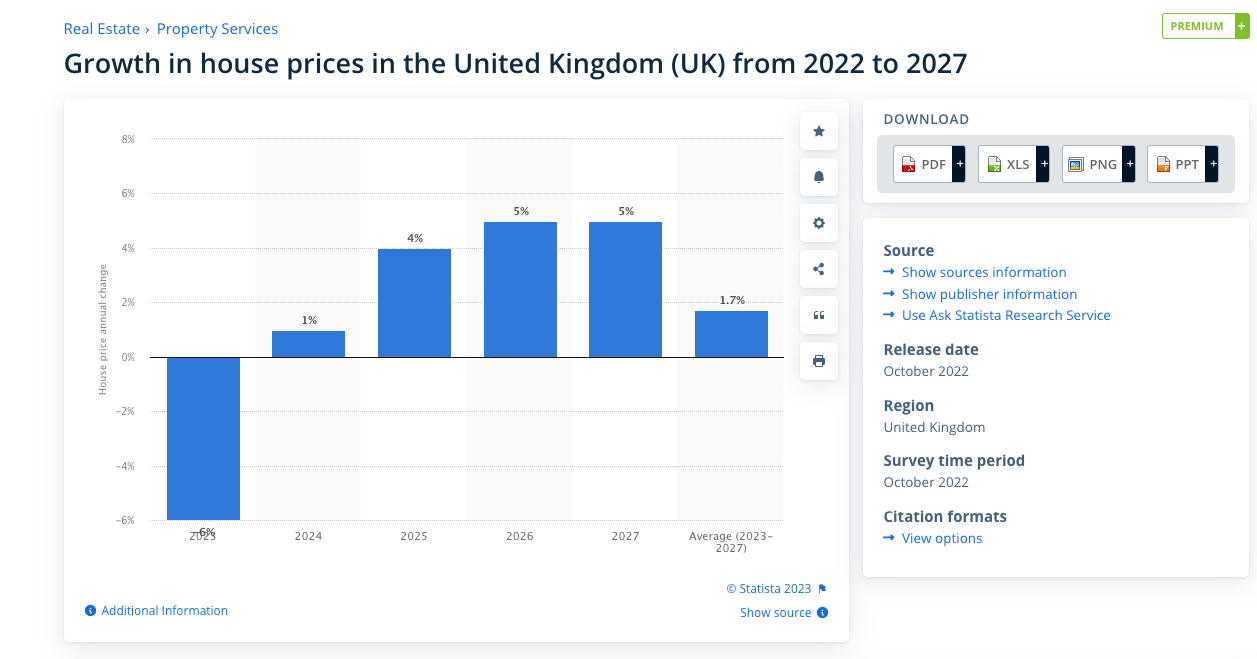

With that in mind, please find details of the growth in house prices in the UK from 2022 to 2027:

For verification purposes, the above information source is from Statista https://www.statista.com/statistics/376079/uk-house-prices-forecast/.

According to the above, in 2025 UK house prices will have risen by 4% which based on 2023 forecasted to allegedly drop by 6%, we will see a correction of being 2% under current market prices.

Industrial Units and Care Homes - With regards to Industrial and Care, both sector end market values are driven by rental income valuations as opposed to bricks and mortar valuations (residential).

Since there’s such a large undersupply of care beds up to 2050, the current rental income levels (averaging at £1,000 per bed per week in East Anglia) are not likely to change due to the low-level supply and high-level demand for them.

Simply put, a recession doesn’t stop time hence the UK population will continue to get older and need much needed care as they enter the later stages of life.

Equally, the demand for industrial units from businesses shows no signs of slowing down. Investment in industrial units is driven by the performance of SME businesses. When SME businesses look to expand, they look for larger premises and typically require industrial units (depending on sector), given the abundance of SME businesses within the UK, the demand for industrial units is strong and yet the supply of units is so small, this means that the rental prices of industrial units will remain stable and therefore the price of industrial units will remain stable.

This means that JaeVee is in a good position when it comes to tackling a recession and means that any risk of price reductions in housing is already priced in due to our conservative nature of how we conduct our feasibility studies.

A recession can therefore be seen as a period of opportunity for savvy investors as there will be less competition and a higher supply of development projects due to companies and individuals needing additional cash during the recession period. All of these factors are what makes JaeVee an attractive option for investors to invest irrespective of whether the economy is in a recession or not.

In summary, a recession is considered a buying opportunity whereby everything is cheaper, as long as the percentage margins remain the same then you’ll make a profit (even with house prices falling) in a property market that continues to be undersupplied.

To see our latest projects available for property investment, please visit this link.

About JaeVee

JaeVee joint ventures with experienced main contractors to bring residential schemes to life in the UK whilst helping to tackle the housing shortage problem. The structure of our model creates equity investment opportunities for investors into these projects, where investors enjoy the profits of a successful development without sacrificing their demands on control, protection and accessibility.

Diverse Property Development Investment Portfolio

Browse our diverse opportunities below, signup to view the full due diligence

and begin investing in your preferred developments.

Project Launch Webinars

This website is operated by the JaeVee Group of Companies. Webpages containing share offers will be hosted by the relevant Group Company that is issuing the shares, as identified on the relevant webpage. Webpages containing mezzanine debt offers will be hosted by JaeVee Holdings Ltd.

JaeVee is a trading name used by all companies within the JaeVee Group of Companies, including JaeVee Holdings Ltd. JaeVee Holdings Ltd is registered in England & Wales with company number 10172481. The registered office of the company is 3rd Floor 86-90, Paul Street, London, England, EC2A 4NE.

JaeVee Holdings Ltd (10172481) undertakes unregulated loan brokerage business that does not entail consumer credit or regulated mortgages. Arrangements by Group Companies to issue their own shares constitute unregulated business pursuant to Article 34 of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (RAO).

Information about investments is only available to investors who demonstrate that they qualify as high net worth individual investors or sophisticated investors or otherwise fall within categories of investor who can receive financial promotions from unregulated persons in accordance with the requirements of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (FPO). Property investing carries the risk of losing some or all of the capital invested. JaeVee does not provide investment advice and investors who are in doubt about whether investing is right for them should consider seeking advice from an appropriately qualified professional adviser.

JaeVee © 2025 • All rights reserved.

.jpg)